Private Equity Investment Management

Industry & Scope :

- Private Equity and Venture Capital, from 'Seed' up to 'Expansion'.

- Related to technology companies in :

- Electronics,

- Software,

- Digital Media,

- Communications,

- Medical Devices and

- Advanced Materials,

which were located in Switzerland, EU Countries and the USA.

Role / Function :

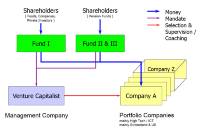

- Investment Partner of a leading Venture Capital firm in Switzerland and ...

- Board Member / Board Observer for several Portfolio Companies.

Business Context :

- Screening and assessing of new investments.

- Investment management of existing portfolio companies.

- Leading / coaching of these portfolio companies at Board and operational level.

Actions :

- Actively coaching, guiding and providing comprehensive support to portfolio

companies in :

- Strategy review, development & implementation.

- The definition of Business Models in line with market requirements,

Go-to-Market Strategies as well as Marketing & Sales Management.

- Planning and implementation of restructuring measures.

- Handling of demanding customer projects.

- Financial planning and controlling.

- HR Management of senior managers.

- IPR Management.

- Managing companies throughout their entire life cycle.

- Operational management of a software company as CEO during a turnaround.

- Jury Member of the Swiss Technology Award.

- As part of the investment management :

- Fund raising.

- Review of potential new investments.

- Due diligences in the context of new investments.

- Re-Financing (Lead Investor and as part of Investment Syndicates),

valuations and negotiation with shareholders, banks & creditors.

- Execution of several M&A Projects (share & asset deals).

- Foundation of a Joint Venture in Italy.

Outcome :

- Achieving the successful turnaround of the above mentioned software company.

- Operationally and financially optimized development of the portfolio companies.

- Successful implementation of exits for several portfolio companies.